Your guide to finding and consolidating post-employment pension funds

Managing retirement savings can be a complex affair, especially when dealing with multiple accounts.

Common Wealth offers an award-winning digital retirement platform that helps Canadians achieve their retirement goals.

We’ve created a modern, low-fee retirement platform that helps you feel more confident about your financial future.

Employers now have an easy and affordable way to offer workplace retirement benefits.

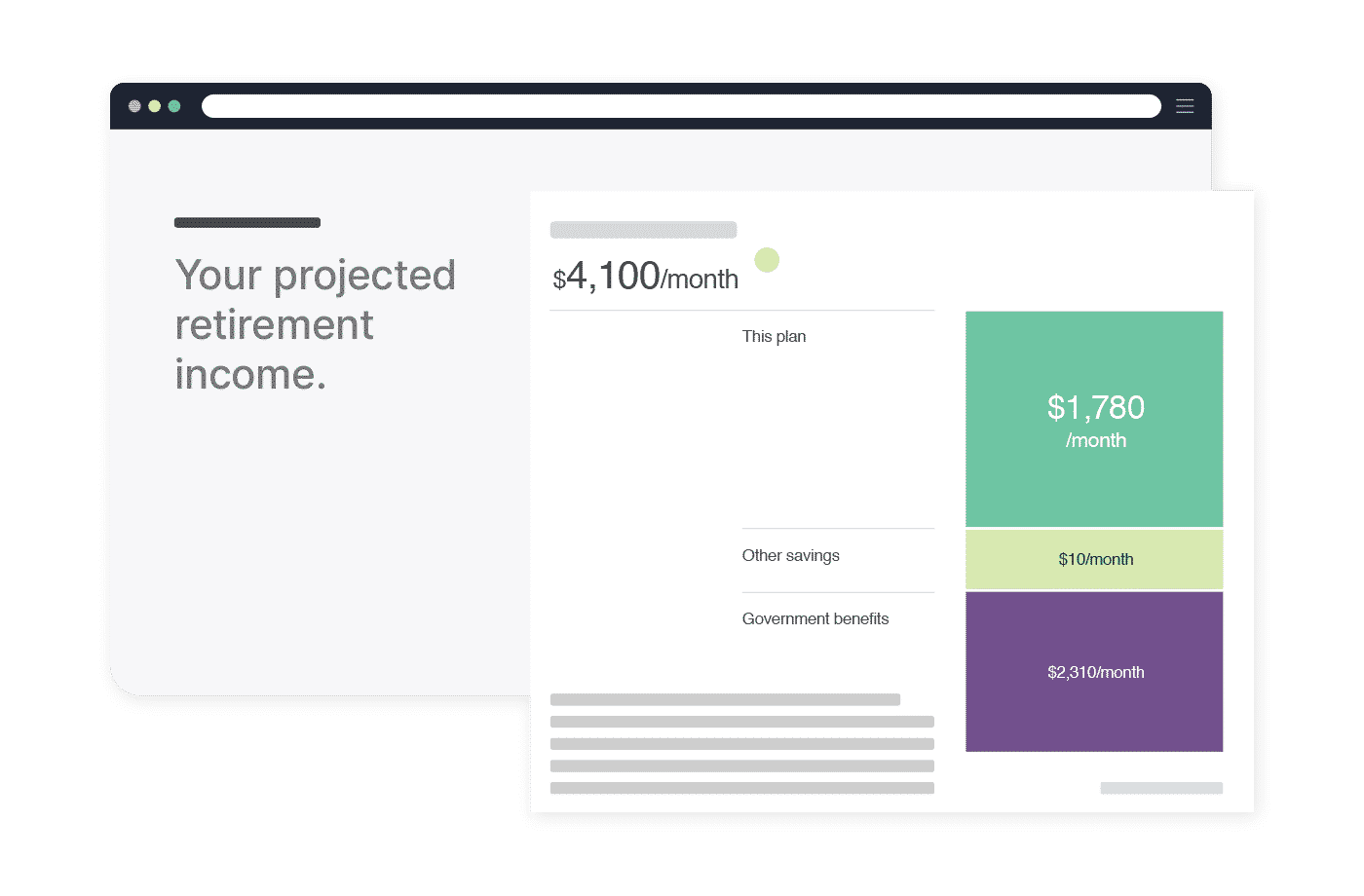

Built-in personalized planning shows you how much you’ll need in retirement, how much to expect in government benefits, and how much to save.

Your plan will show you how to maximize government benefits such as CPP, OAS, and GIS. When you’re ready to retire, we’ll help you make the right decisions so you get the most out of every dollar.

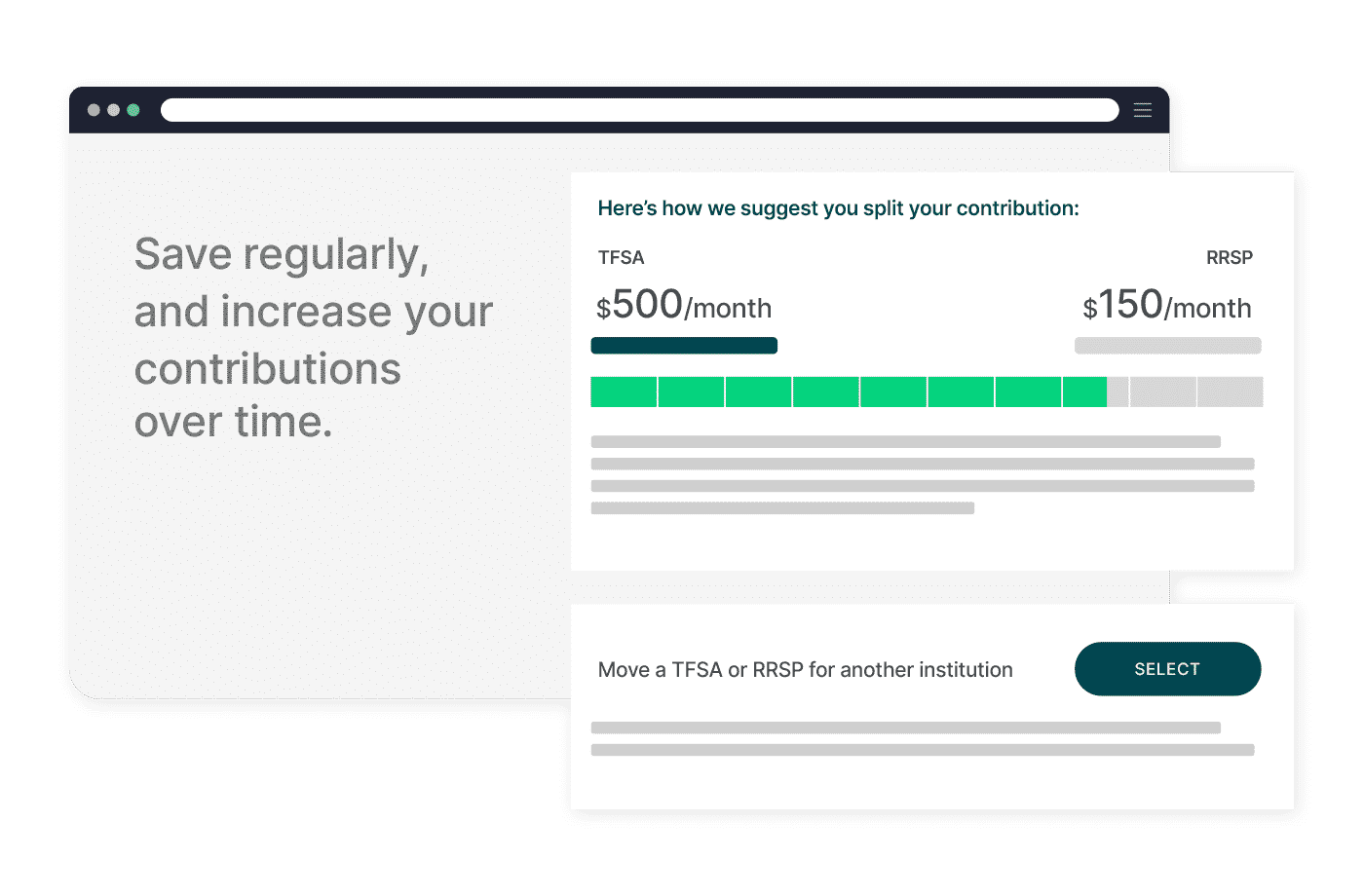

With an RRSP and TFSA in every account and automatic investing in a well-balanced, diversified portfolio, it’s easy for all income levels to grow their savings.

Low fees have a significant impact on your retirement savings. Use our retirement calculator to find out how much you’ll need to save to achieve your goals.

Managing retirement savings can be a complex affair, especially when dealing with multiple accounts.

We’re so happy to have been named the Most Innovative Company in the Pension & Retirement Industry in the 17th annual World Finance Awards.

To help make sure that all of your 2023 payroll contributions are counted for this tax year, and your employees get the tax documents…

The business case for good workplace retirement plans

Explore how a good retirement plan creates value for employers and strengthen an employer’s bottom line.

Employees can set up a personalized plan in about 10 minutes that lets them customize their savings strategy with monthly income goals and then track their growth with our user-friendly dashboard.

Our plans suggest how much to save and automatically adjust your retirement goals and recommendations when there are changes to your contributions or income.

We’ve made investing easy by matching you to an age-appropriate fund, delivered by world-class asset managers that specialize in investing for retirement.

We’ve taken the guesswork out of retirement with in-app suggestions that help you decide when to save to an RRSP and TFSA, so you can minimize taxes and maximize your savings.

Common Wealth offers an affordable plan. With no hidden fees or commissions, you’ll pay up to 70% less than most Canadians to build a right-sized retirement nest egg.

HOOPP – Healthcare of Ontario Pension Plan

Canadian Retirement Survey

Common Wealth is an award-winning digital retirement platform, earning awards for innovation in plan design and technology from the international wealth management publication Pensions & Investments, and for pension leadership from Canadian Investment Review magazine.

Sign up today to get the latest retirement savings advice delivered straight to your inbox

© 2024 – All Rights Reserved

Find what you’re looking for: